Real Estate Observer This newsletter will provide frameworks & analysis you can use to confidently invest your capital in private market real estate. It is written from the perspective of someone who reviews many deals in search of one that fits my personal or my investor community’s preferences. To keep up with what I’m working on, click here. |

Recent Articles:

The Illiquidity of Real Estate

We’ve all been at a Thanksgiving dinner with that one uncle who won’t stop talking about stock tips. Most of the time, we just roll our eyes and move on, but after a couple of spiced apple cider bourbon cocktails, you might actually decide to buy that stock.

Since this stock is traded on public exchanges like the NYSE or Nasdaq, you could turn around the next day and sell it at the current market price. It might have gone up a little, or maybe it went down, but either way, you can access those funds quickly without too much hassle—leaving you with just the cocktail-induced headache.

This all comes down to liquidity.

Liquidity refers to how easily and quickly you can buy or sell an investment without causing a significant change in its price.

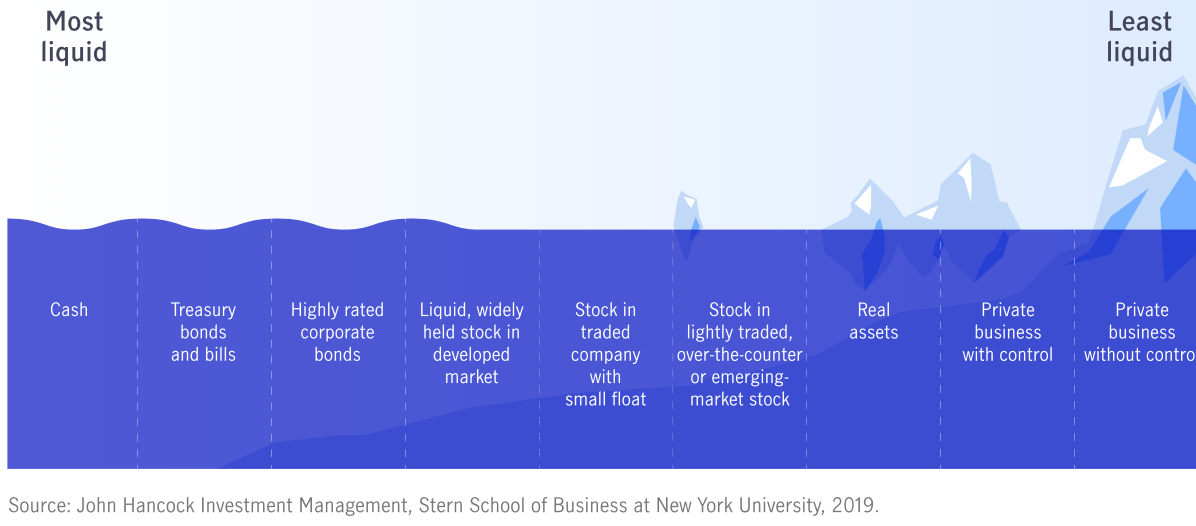

Most types of real estate are considered relatively illiquid. As shown in the chart above, "real assets" rank third in terms of illiquidity, just behind private businesses with and without control.

Imagine buying a home and deciding to sell it two years later. Depending on the market, the process could take anywhere from 20 days to six months to complete—a far cry from the near-instant trades possible with stocks. While selling a home is relatively slow compared to stocks, you do have control over the timing of the sale, which provides some flexibility.

Illiquidity takes on a whole new meaning in private market real estate deals, where your investment is not just slow-moving but essentially locked away in someone else’s hands.

As a limited partner (LP) in a real estate investment, you're investing in a tangible asset, but you have no control over the management or timing of the investment. This is more similar to investing in a private business with no control (placed toward the far right of the illiquidity spectrum in the chart above).

As an LP, your hands-off role can be both an advantage and a disadvantage. On the one hand, you avoid the following headaches:

Building and maintaining relationships with brokers, lenders, insurance agents, tax specialists, and other deal parties.

Increased liability that the general partner (GP) assumes.

Managing accounting, compliance, and fundraising tasks.

Overseeing construction, property management, investor relations, dispositions, and refinances.

However, this comes at the cost of giving up complete control of when the asset is sold or any other decisions.

An LP might consider investing in a single-asset multifamily deal where the GP projects a three-year expected hold period. This means you can expect to have your capital returned, along with any potential returns, by the end of year three.

A common strategy used by operators in 2021 was to secure three-year debt with the intention of selling by the end of that third year.

According to Matrix analysts, "Multifamily originations peaked during years of record transaction volume, including 2021 ($194.7 billion in loans originated) and 2022 ($209.8 billion), when investor demand was high due to strong fundamental performance and low interest rates."

Currently, of the loans in their database, $61.8 billion are set to mature in 2024, with another $84.3 billion in 2025, $89.3 billion in 2026, $77.9 billion in 2027, and $107.3 billion in 2028. You can view the full article here.

However, market dynamics can disrupt these plans. Many of the loans originated in 2021-2022 were at peak pricing and since then valuations have declined. Operators/GPs may choose to:

Sell the deal in year 3, which could result in lower than projected returns for you as the LP, or even a loss of some or all of your capital.

Extend the initial loan for an additional 1-2 years and then sell.

Attempt a refinance into longer-term debt, hoping the market will stabilize before eventually selling.

For example, let’s say the operator opts to refinance into a 5-year fixed-rate loan with a hefty prepayment penalty. This means the operator likely needs to hold the asset for the full 5-year term of the new loan before selling, to avoid paying a large prepayment fee.

In this case, the investment timeline extends beyond the original 3-year plan. With the initial 3-year hold period followed by an additional 5 years to allow the market to stabilize and appreciate, the total holding period could be 8 years.

For seasoned investors, shifts in investment timelines are simply part of the calculated risks associated with private market real estate. They understand that these dynamics are common, while newer investors may not fully realize the factors at play.

Before making any investment, but especially in private market deals where they have no control, investors should carefully analyze their personal financial goals and risk tolerance.

Illiquidity isn’t inherently bad—it just needs to be recognized. For example, one key reason private real estate investments are expected to offer higher returns than public equities (like stocks) is the "illiquidity premium." I'll dive into that more next week!

Thanks for following along!

Thanks for reading! If you’re interested in North Carolina single-family development or existing multifamily opportunities, you can follow along by clicking here. I usually only come across 1–3 deals per year that are worth investing in.