Real Estate Observer This newsletter will provide frameworks & analysis you can use to confidently invest your capital in private market real estate. It is written from the perspective of someone who reviews many deals in search of one that fits my personal or my investor community’s preferences. To keep up with what I’m working on, click here. |

Before we dive in, it's important to recognize that the environment is constantly evolving, and the return premiums investors seek for owning real estate can vary depending on a range of market conditions and individual investor preferences. In some cases, investors may even question whether an illiquidity premium exists at all…

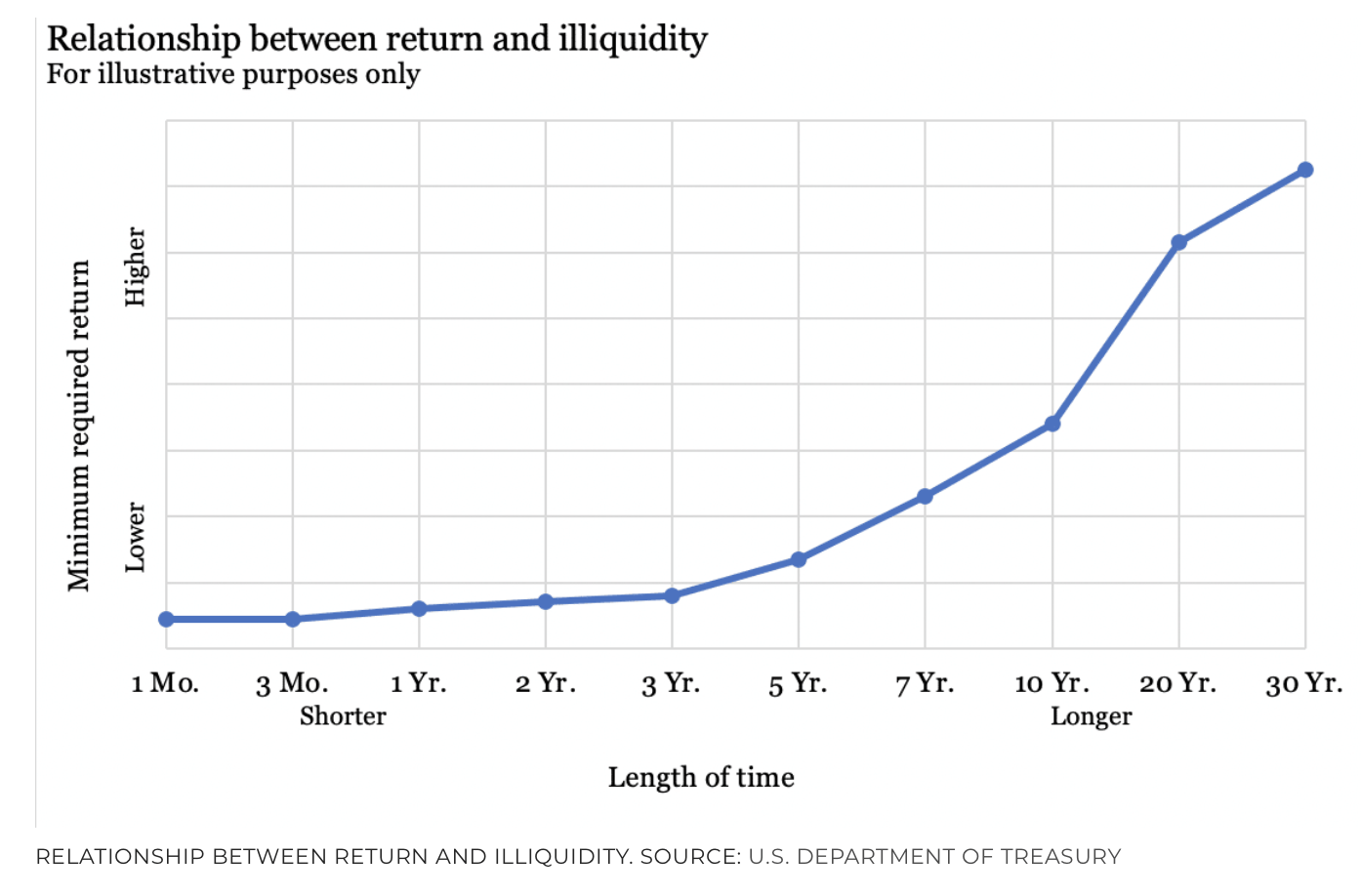

At its core, the illiquidity premium refers to the extra return investors demand for locking up their money in an asset that can’t be quickly or easily sold. Unlike publicly traded stocks or bonds, which can be liquidated with a simple click, buying or selling real estate takes significant time and transaction costs.

By investing in an asset that is not easily tradable, investors should expect a higher potential return as compensation for the patience required and risk of being unable to exit the investment quickly.

The great David Swenson said that the, “intelligent acceptance of illiqudity and a value orientation, constitutes a sensible, conservative approach to portfolio management”. Swensen is highlighting the attributes of the potential for higher returns due to the premium that can be captured by investing in illiquid investments such as private equity, credit, and real estate.

Swensen spent 31 years as the Chief Investment Officer of the Yale Endowment fund where he was able to allocate up to 50% of the total portfolio to illiquid investments, with a total portfolio value of 41 billion.

Most individuals would find such a portfolio allocation uncomfortable, but it illustrates that those who are able to handle illiquidity in their portfolios may ultimately perform better than those who cannot.

Caption: This report shows that global UHNW (Ultra High Net Worth) family offices allocate 45% to alternative, illiquid investments.

Why Does Illiquidity Command a Premium?

The illiquidity premium exists because investors and markets place value on optionality. As the landscape constantly evolves, the ability to react quickly with up-to-date information becomes crucial. However, when investing in most private market real estate, investors lose that flexibility.

Factors That Influence the Illiquidity Premium:

Investment Horizon: The longer your capital is locked up, the higher the illiquidity premium is likely to be.

Market Conditions: During times of economic uncertainty, illiquidity premiums generally increase. Investors require more compensation for locking up their capital when the future is less predictable.

Asset Quality and Location: A prime asset in a top location typically has a lower illiquidity premium compared to a speculative deal in an emerging market.

A. For example, a trophy property in a prime area is far less likely to face difficulty selling at a reasonable price than a class D multifamily property in Odessa, Texas, which you wouldn’t even tour without armed guards 🙂

Investor Profile: The goals of institutional investors and individual investors will often differ significantly. Larger investors can accept lower returns than individual investors, who typically expect higher returns.

Practical Considerations for Individual Investors:

Stress-Test Your Liquidity Needs: Before committing to a private real estate deal, ensure you have enough liquid assets elsewhere in your portfolio to cover emergencies, unexpected expenses, and monthly cash burn.

Understand the Exit Strategy: Ask detailed questions about how and when you can exit the investment. Is there a secondary market for your shares? Usually there's not, in my experience. Are there penalties for early withdrawal? What happens if the market takes a downturn?

Think Long-Term: The illiquidity premium rewards patience. If you have a short-term mindset, you’re less likely to capture the benefits this premium offers.

Why Could the Illiquidity Premium be Going Away?

1. Enhanced Market Liquidity

Real estate has evolved into a global asset class, attracting institutional investors, sovereign wealth funds, and family offices from all over the world. More buyers lead to greater liquidity.

The rise of CMBS (Commercial Mortgage-Backed Securities) funding for real estate has significantly improved liquidity, especially since the passage of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989.

Also, the extended period of low interest rates over the past decade has driven investors toward alternative assets, including real estate, in search of higher returns. This influx of capital has led to yield compression, where increased demand has driven prices up and squeezed yields, leaving less room for an illiquidity premium. The large volume of capital chasing deals has reduced the perceived risk of illiquidity, thereby diminishing the premium.

2. Advancements in Data and Transparency

The availability of market data has increased tremendously. This means that investors all have access to most of the up to date information for a given market or asset class. This allows for better price discovery, as investors can more accurately value assets, reducing the uncertainty that traditionally warranted a higher illiquidity premium. Transparency lowers perceived risks, making investors more comfortable with real estate as an asset class.

3. Changing Investor Behavior

Investors are increasingly willing to accept lower returns in exchange for stability and predictable cash flows. Real estate's reputation as a relatively stable investment during periods of market volatility has led to adjustments in the risk-return profile, where investors may now view the stability of real estate cash flows as partially offsetting its illiquidity, reducing the premium required.

What does all this mean for you, as an investor?

Whether the illiqudity premium is shrinking or not, there will always be real estate investments that individuals can take advantage of.

When evaluating real estate investments, investors must take a comprehensive look at the opportunity and assess whether the risk versus reward aligns with their personal goals. Recognizing the potential for a premium on your capital by accepting illiqudity presents an opportunity, but it’s important to remember that nothing comes without trade-offs. By increasing illiqudity, you may also be increasing your risk.

Illiqudity is just one piece of the puzzle. There are numerous other risks and factors to consider when investing as a limited partner, which is what we’ll continue to explore in this newsletter.

Thanks for reading! If you’re interested in North Carolina single-family development or existing multifamily opportunities, you can follow along by clicking here. I usually only come across 1–3 deals per year that are worth investing in.