Real Estate Observer This newsletter will provide frameworks & analysis you can use to confidently invest your capital in private market real estate. It is written from the perspective of someone who reviews many deals in search of one that fits my personal or my investor community’s preferences. To keep up with what I’m working on, click here. |

When I initially began looking into private real estate investments, I struggled to find reputable real estate sponsors. Starting out, there are so many unknowns, and it’s overwhelming trying to figure out how to assess real estate firms and their specific deals.

The first step is to identify sponsors so you can begin understanding their overall investment approach and target asset class. This will help you as you begin to understand these kinds of investments, the more deals you are exposed to.

What is a Sponsor or General Partner?

I’ve discussed this in more detail here. To summarize, a real estate sponsor is an individual or company responsible for finding properties, securing funding, and managing the investment. While there are many general partners (GPs) involved in real estate deals, as a limited partner (LP), it can be challenging to ensure you're considering investments with a decent sponsor.

This type of investing is unregulated in many ways, and issues like dishonesty, inexperience, and even fraud can become evident as you gain more experience—though they might not be as apparent if you're just starting out.

How to Find Real Estate Sponsors

Leverage Your Network

Real estate is fundamentally a people-driven industry, and that won’t change, even with the rise of robots, self-driving cars, and AI shaping the economy 🙂 Tap into your existing network to find out if anyone has been involved in a syndication or private real estate deal. What was their experience like? Would they recommend the sponsor they worked with?

However, just because someone had a positive experience doesn't mean you should automatically invest. For example, the firm mentioned in this article achieved impressive returns from 2017-2022, leaving many investors satisfied. But fast forward, and they are now facing lawsuits from both investors and lenders due to a significant portion of their portfolio heading into foreclosure. Even seasoned investors have lost money in these deals. Read More Here. I don’t believe anyone could make up the irony of this investment firm’s name, as they certainly saw the tide go out.

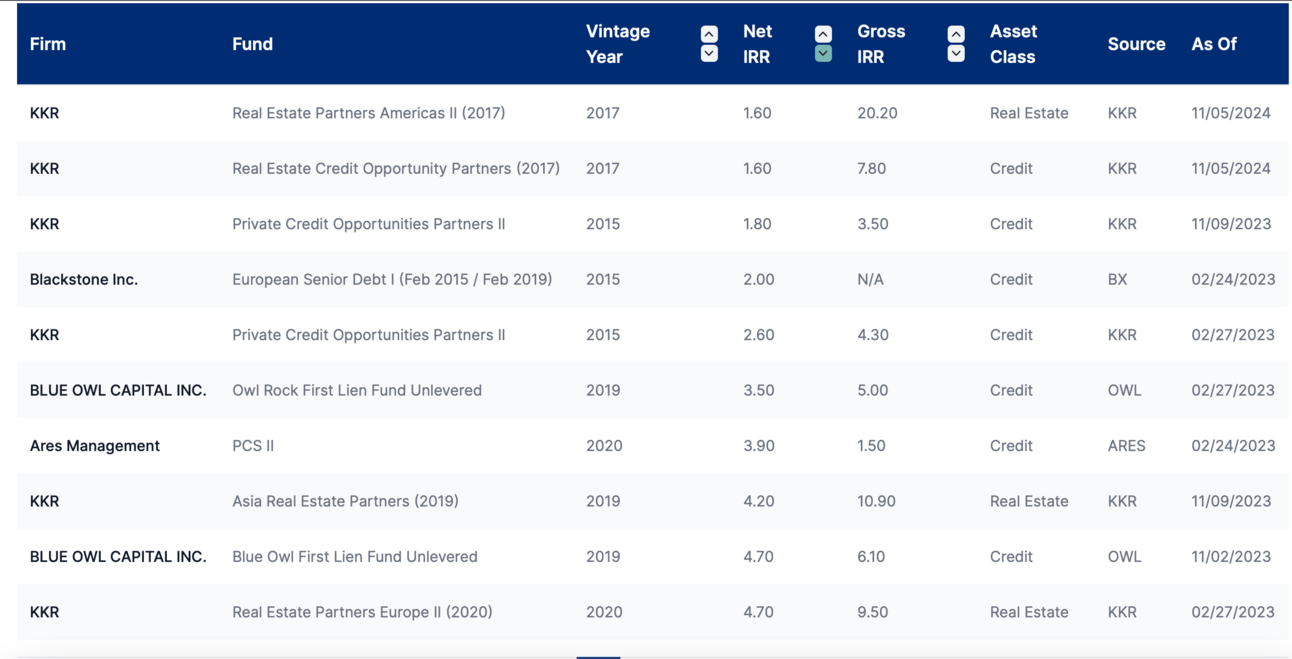

Search for real estate sponsors in your target asset class. Warning: be cautious when searching, as you may come across a wide variety of results. The size of a firm doesn't necessarily equate to delivering exceptional returns—or even market-average returns.

Even some of the largest private equity groups in the world deliver bad results sometimes. Read Here.

Try searching for terms like:

"Multifamily syndication firms in the Southeast"

"Industrial real estate firm in Texas"

"Multifamily real estate firm in Charlotte, NC"

You get the idea…

Once you identify potential sponsors, consider signing up on their website to receive updates and the opportunity to schedule a call, provided they pass your initial “sniff” test.

Attend Industry Events

Conferences, webinars, and networking events are full of sponsors seeking their next investor. You'll collect plenty of business cards, so take note of who you connect with and continue the conversation. While these events offer valuable opportunities, they can also be costly and time-consuming. The other methods of connecting with sponsors can be just as effective.

Social Media

Platforms like LinkedIn and even X can be a good place to find and connect with real estate sponsors. The more exposure, the more you can learn.

You can also gain insight into how they approach real estate deals, their investment philosophy, and their overall demeanor. This can help you decide if it's worth scheduling an introductory meeting.

Pay attention to their marketing materials. Are they sophisticated and well-thought-out, or do they come across as inexperienced and gimmicky?

What’s Next?

Now that you've connected with various sponsors online, at events, and on LinkedIn, it's time to narrow your list.

Look for obvious red flags:

Overly Aggressive Sales Tactics: Do they pressure you to invest quickly or promise unrealistic returns?

Negative Online Reviews: Are there troubling complaints or reviews from previous investors?

If a sponsor’s approach aligns with your investment goals and you haven't noticed any red flags, it’s time to reach out and schedule an intro call. Building genuine relationships with sponsors is essential. Don’t rush into any investment until you feel confident in their expertise and integrity.

Remember, you won’t miss a “once-in-a-lifetime generational opportunity,” and if someone pitches you with that kind of language, it’s a major red flag regarding their ethics or expertise.

Stay tuned for my next article on the key questions to ask during your first call!

Thanks for reading! If you’re interested in North Carolina single-family development or existing multifamily opportunities, you can follow along by clicking here. I usually only come across 1–3 deals per year that are worth investing in.