Real Estate Observer This newsletter will provide frameworks & analysis you can use to confidently invest your capital in private market real estate. It is written from the perspective of someone who reviews many deals in search of one that fits my personal or my investor community’s preferences. To keep up with what I’m working on, click here. |

REAL ESTATE OBSERVER RECENT ARTICLES 📰

Risk for LPs : Rescue in Multifamily

This being my first real estate “down” cycle, it has amazed me how slow moving it is. For most people under 35, this represents the first genuine real estate down cycle of their investing career. The COVID disruption of 2020, while dramatic, actually benefited many deals with unprecedented rent growth and cap rate compression that saved most deals. So right now, for the first time in ~15 years we are dealing with a relative amount of high distress.

The core issue stems from deals acquired during the market peak of 2021-2022. Many of these properties now have zero or negative equity, with owners facing capital loss as loans mature and forced sales loom. Some investors have already lost their entire investment.

This has triggered a wave of "rescue capital" offerings as sponsors desperately attempt to save their failing deals and preserve investor relationships.

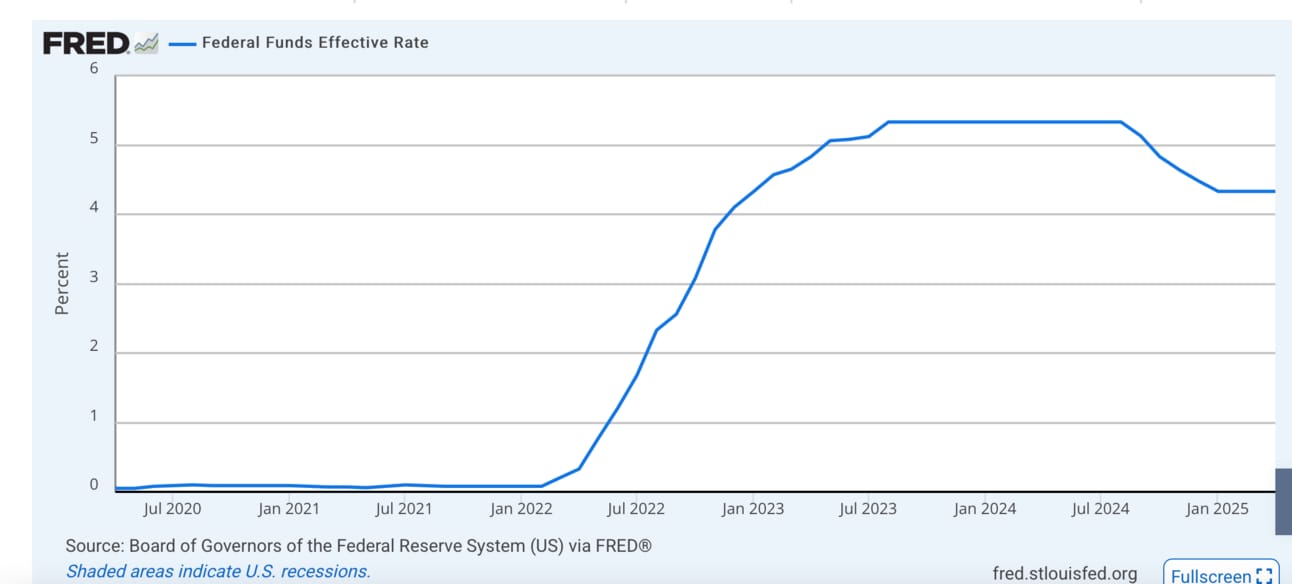

Part of the reason 2021-2022 had peak valuations were the ultra low interest rates

I’ve seen a few scenarios an operator/sponsor can try in an attempt to save original investor capital, or at least avoid foreclosure.

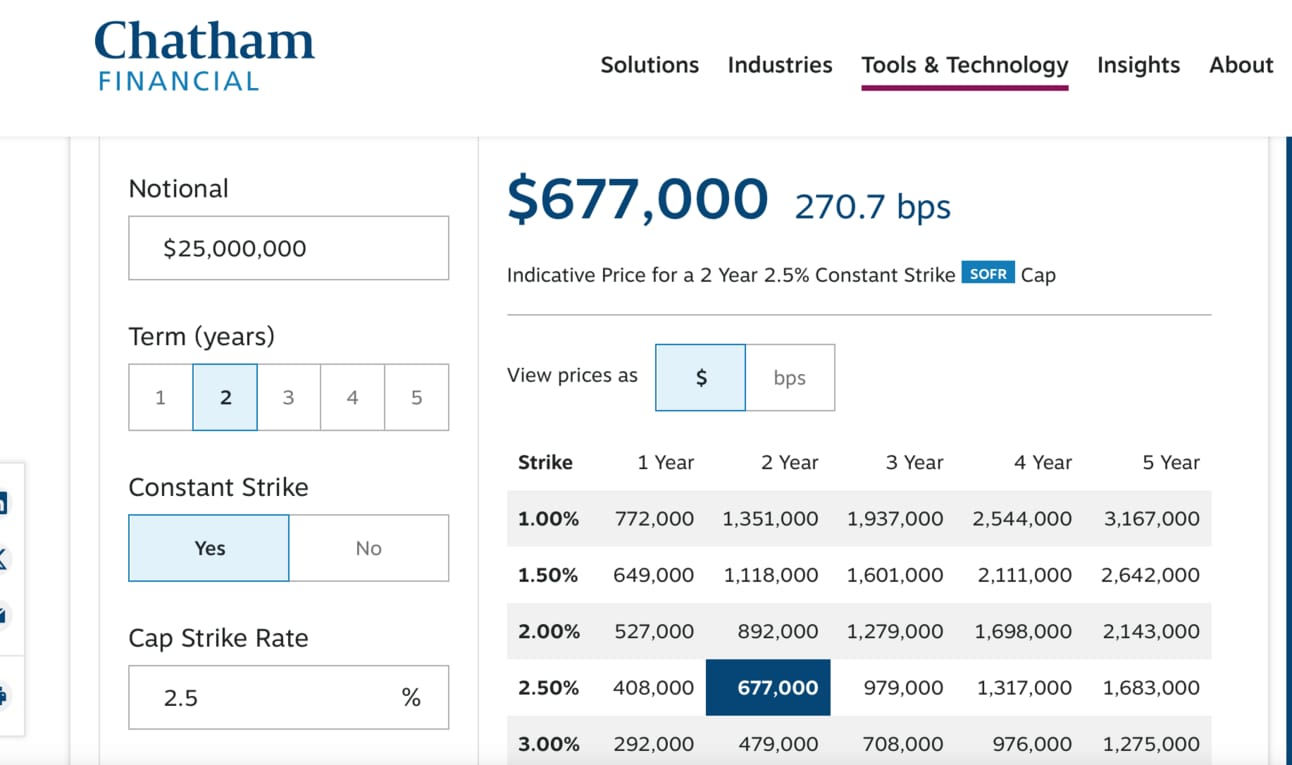

Capital call to purchase rate cap, and extend loan by 1-3 years. You can learn more here: What Are Rate Caps?

Potential cost of a 2 year rate cap on a $25,000,000 loan with a strike of 2.5% SOFR (all in interest rate somewhere around 5.5%).

Capital call to perform cash IN refi for long term debt (5+ years)

This will likely require much more capital, but if reasonable it could actually save the initial common equity due to the longer time horizon.

We are also seeing a lot of preferred equity and private credit offerings that are essentially capital calls, mostly trying to raise funds to extend the loan, like in #1.

Caveat: I am invested into a private credit fund, but the fund does not invest into rescue capital type opportunities like I describe in this article. Generally they are providing equity at a combined LTV (senior + our sleeve of pref or mezzanine) of 65% LTV. It has been netting me ~10%, which I am happy with for what I feel like is a lower risk proposition.

The variations of these rescue types of offerings are wide. Some firms are being transparent that they are raising capital from new (and existing) LPs to invest “preferred equity” into failing/distressed deals. I commend the transparency…although I wouldn’t touch most of these investments personally.

There are also firms that are out there raising “preferred equity”, WITHOUT being transparent that they are going to use it in an attempt to save their own failing deals. These are not small/no-name firms. These are groups with huge portfolios and thousands of investors.

Many sponsors aren’t necessarily acting in bad faith—they're just trying everything possible to save their deals and investor relationships. However, that doesn't mean you should join them in what may be a futile rescue mission…. and certainly not if they aren’t being transparent. There’s also the chance that one of these rescue operations actually presents a good investment opportunity-I would just be very vigilant.

Why New Acquisitions Beat Rescue Operations:

Even with similar projected returns, I see more opportunity in new acquisitions today rather than rescuing peak value-era deals:

Better Entry Pricing in Current Market

No Legacy Operational Issues

Cleaner Capital Structures

More Transparent Risk Assessment

Calling capital to purchase a rate cap can be a bit like a Band-Aid on a knife wound. If you’re an LP who is considering making the capital call or investing in “preferred equity” that will purchase a rate cap/extend the loan, proceed with caution. You must understand the value of the asset today and where it needs to be by the end of the loan term to avoid loss of capital.

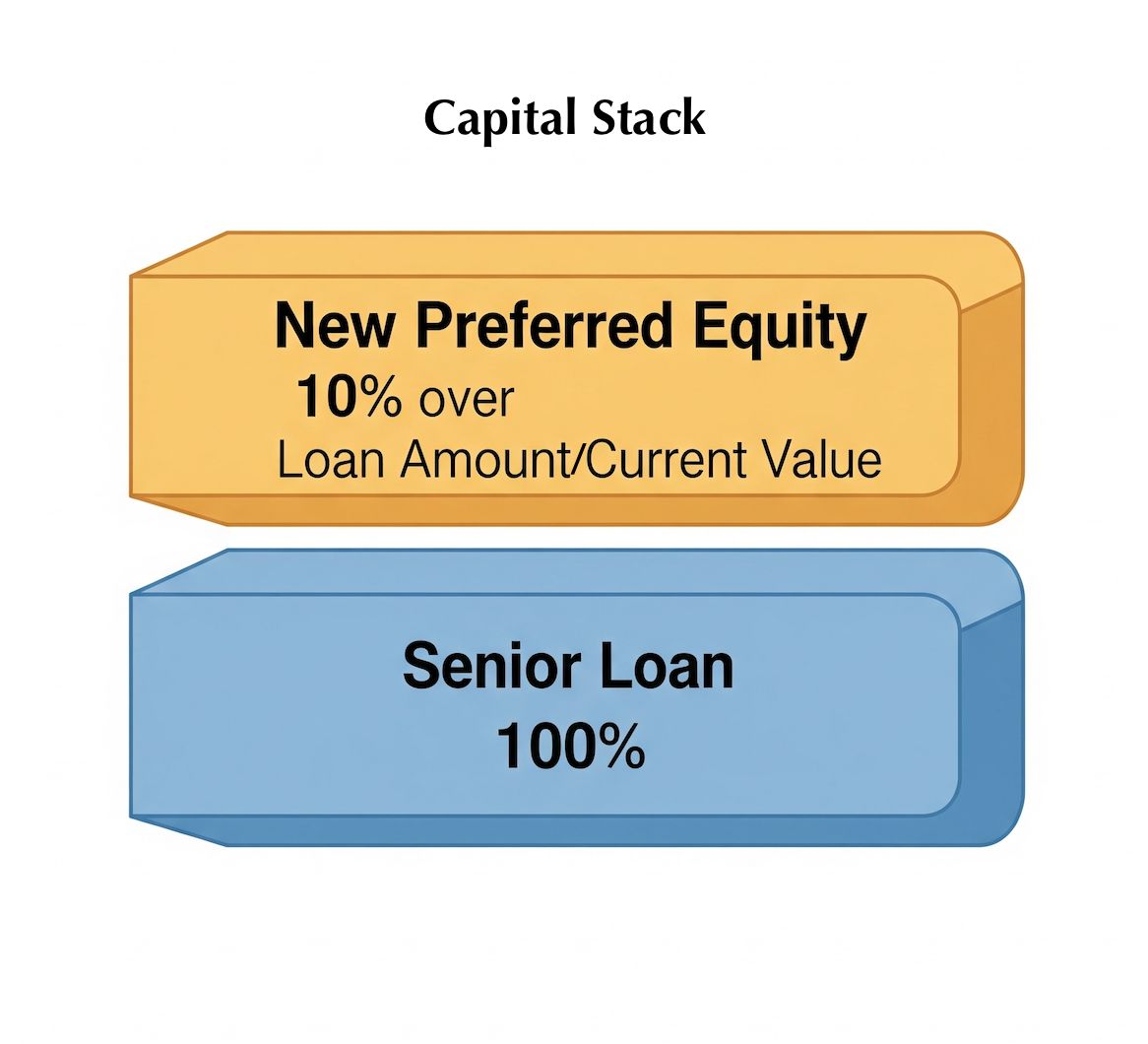

This shows the senior (existing) loan as 100% of the current value of the property.

Many 2021-2022 Deals Now Face a Capital Structure Where:

Senior Debt = 100% of Current Property Value (or Worse)

Common Equity = $0 or Negative

Now if you were to invest equity (preferred or common) into this type of offering, the property must appreciate 10%+ minimum just to return your sleeve of rescue equity. Doesn’t sound low risk to me.

For Existing Investors Facing Capital Calls:

Rate Cap Extensions (1-3 Years):

Could be throwing good money after bad

Only consider if you have deep conviction in near-term market recovery

Understand you might be gambling too heavily on timing

Long-Term Refinancing (5+ Years):

More defensible if you can secure reasonable terms

Provides actual runway for market recovery

Still requires significant additional capital commitment, but if it saves your original equity in a deal, it would likely be worth it. Losing capital is really, really hard to make up.

For investors without the baggage of 2021 era deals, rescue operations don’t justify the risk-reward profile compared to new opportunities in today's market, IMO.

Thanks for reading! If you’re interested in North Carolina single-family development or existing multifamily opportunities, you can follow along by clicking here. I usually only come across 1–3 deals per year that are worth investing in.