Real Estate Observer This newsletter will provide frameworks & analysis you can use to confidently invest your capital in private market real estate. It is written from the perspective of someone who reviews many deals in search of one that fits my personal or my investor community’s preferences. To keep up with what I’m working on, click here. |

Keeping up with market data, especially during “noisy” periods like this, is crucial for investors. During times that are full of confusion and negative sentiment, some of the best investment opportunities can emerge. It’s when everyone is ultra positive and “risk on” that you should pull back and make sure your investments are able to weather some storms. Just look at those who invested in multifamily properties in 2021—many of those deals aren’t looking so great now.

Fortunately, I did not invest in any of those 2021 deals due to my knowledge, foresight, and experience lack of investment liquidity at the time.

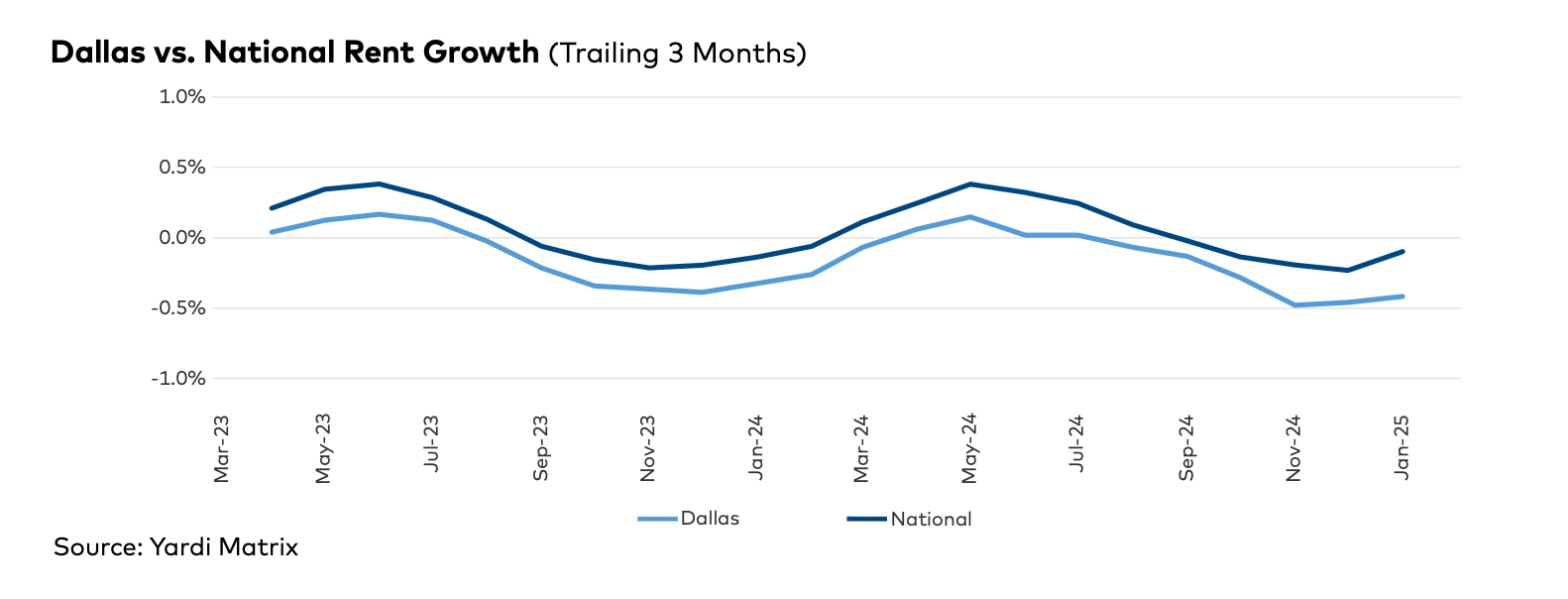

As an LP, your role is meant to be passive, but it’s essential to have a solid understanding of the data at a high level to assess whether the projections you’re being presented with are realistic. For example, if someone is forecasting 6% organic rent growth in Dallas, TX for 2025/2026, they might be able to explain their reasoning. However, it’s your responsibility to recognize that there’s no credible basis for expecting that level of rent growth, and that’s where understanding the data becomes critical.

Today, let’s take a closer look at Dallas. We invested in a ~2000 year built Dallas asset in 2023. So far, we’re meeting expectations. We are slightly exceeding our NOI projections for this period, which we’re pleased with, especially considering the new supply challenges everyone is facing. As we hold steady, we should benefit from rent growth eventually, though it’s unlikely to be significant this year. Let’s dive deeper.

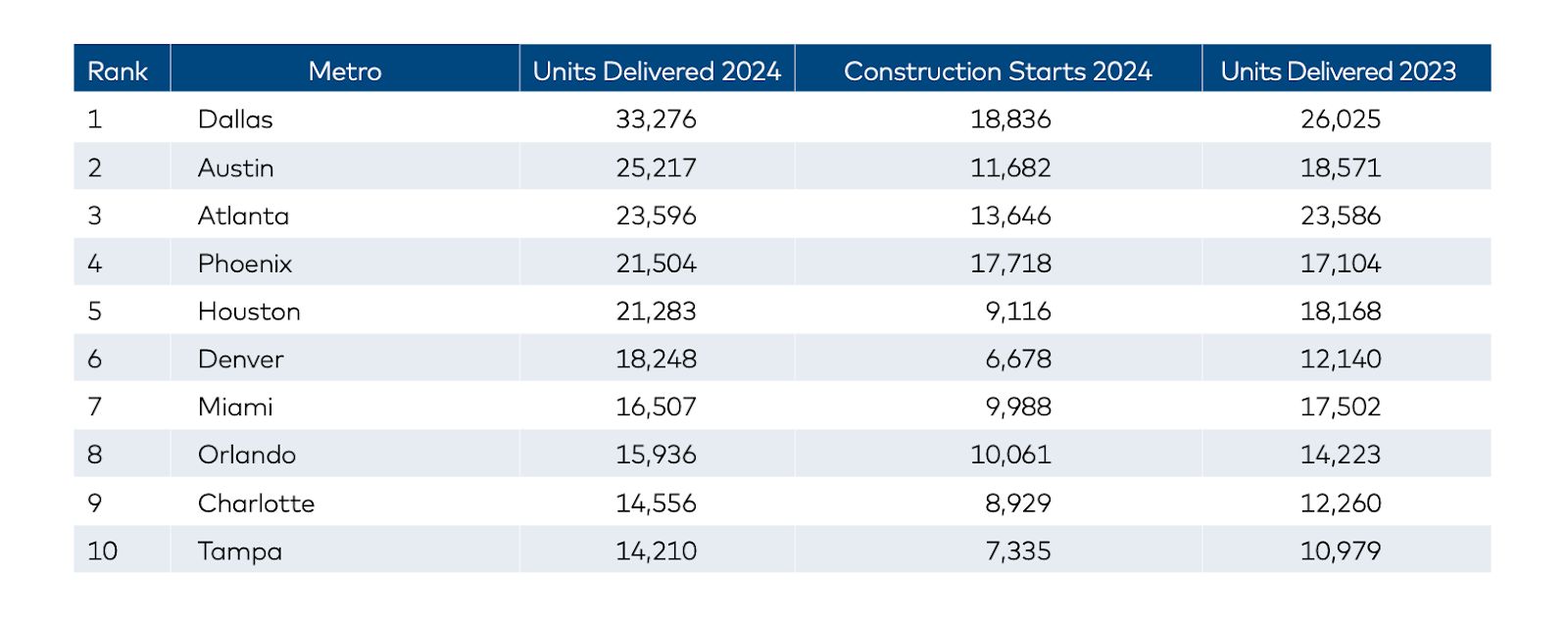

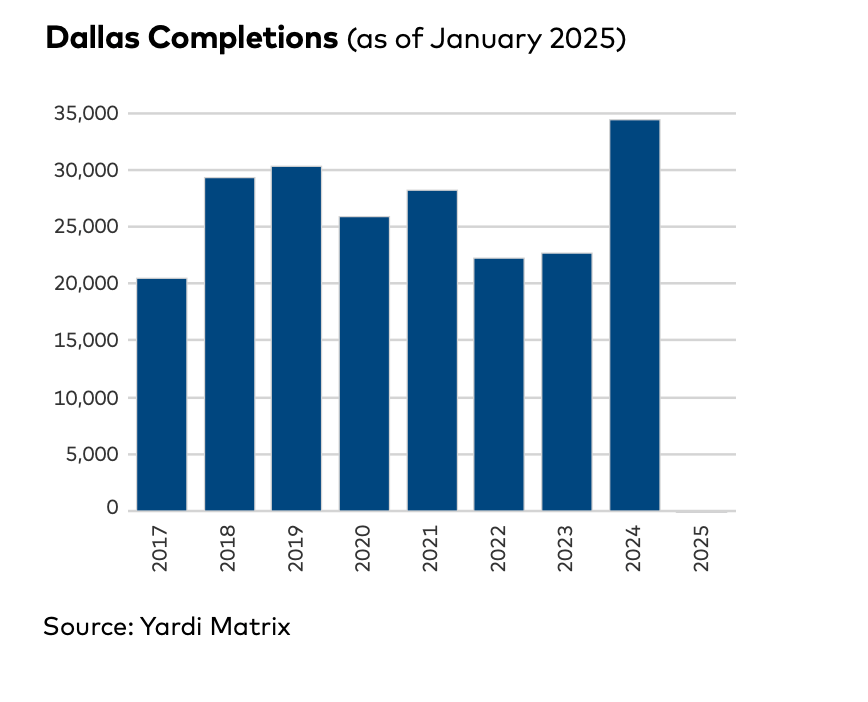

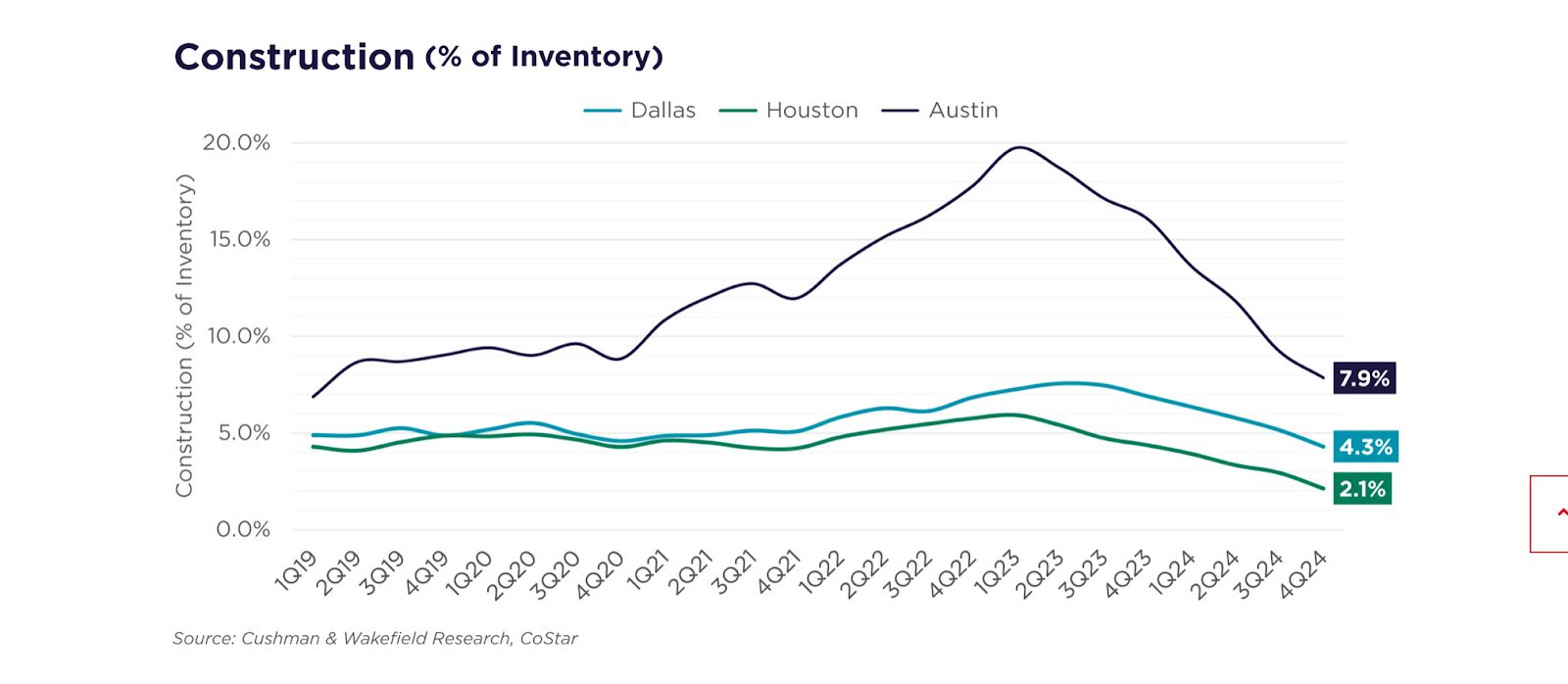

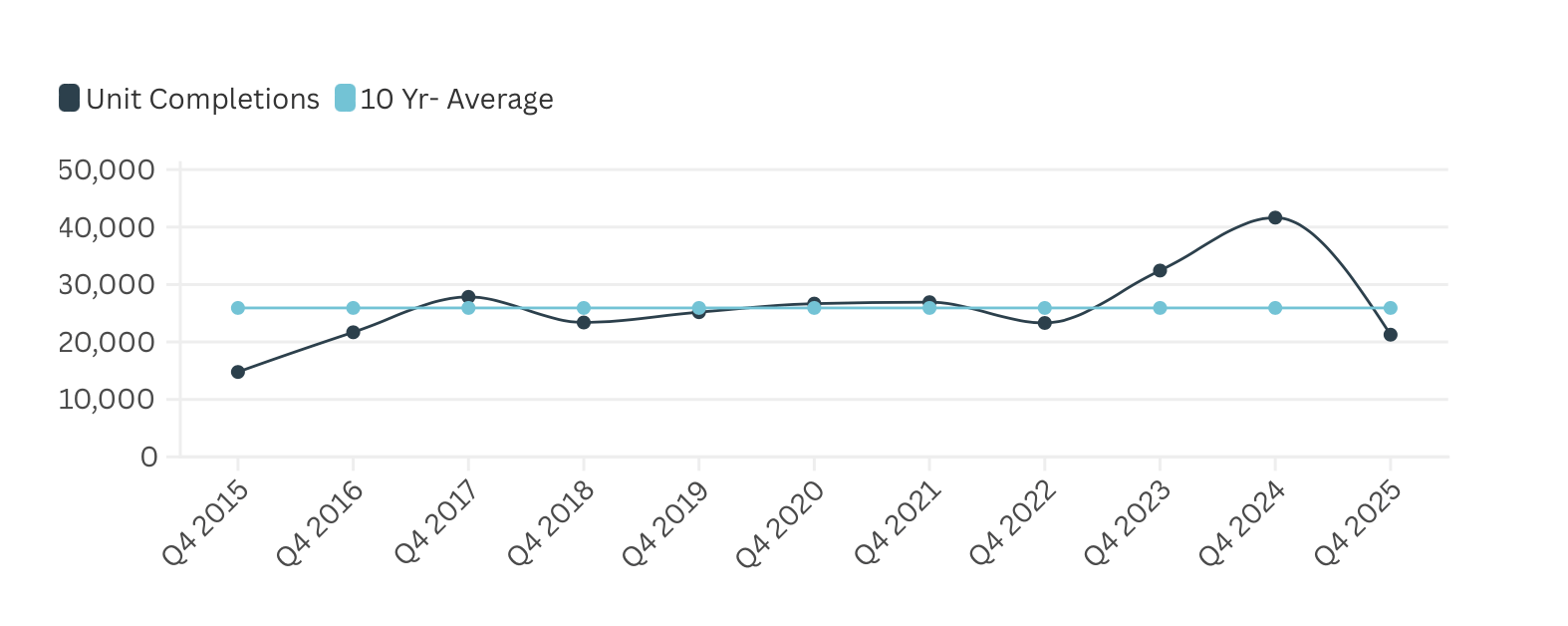

In 2024, Dallas led the nation in new construction completions, delivering 33,276 units across 127 projects. That’s a huge amount of supply.

Source: Yardi

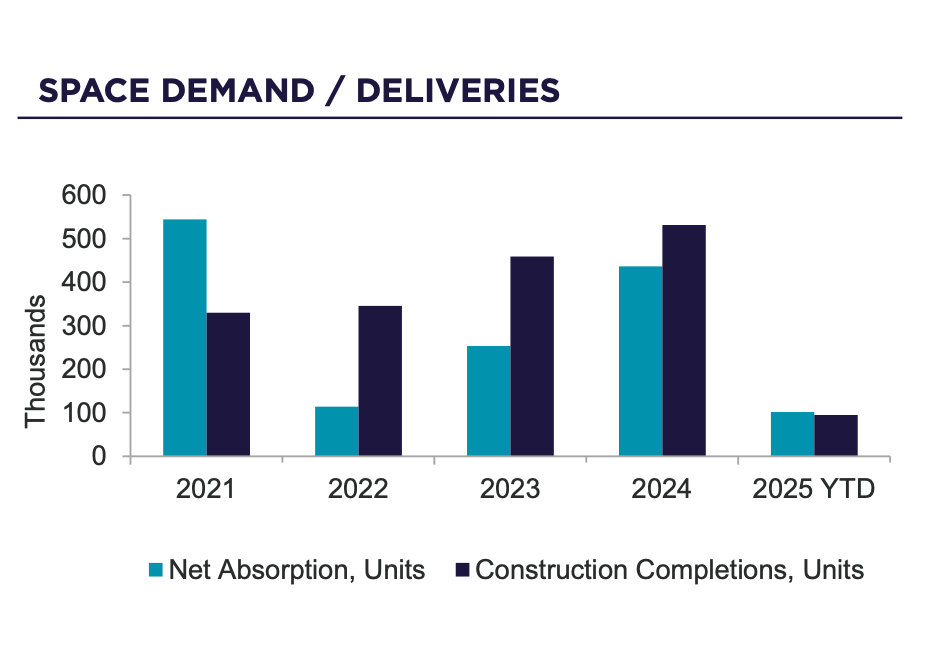

All of those projects that started in 2021-2022 with ultra low interest rates are in the process of delivering.

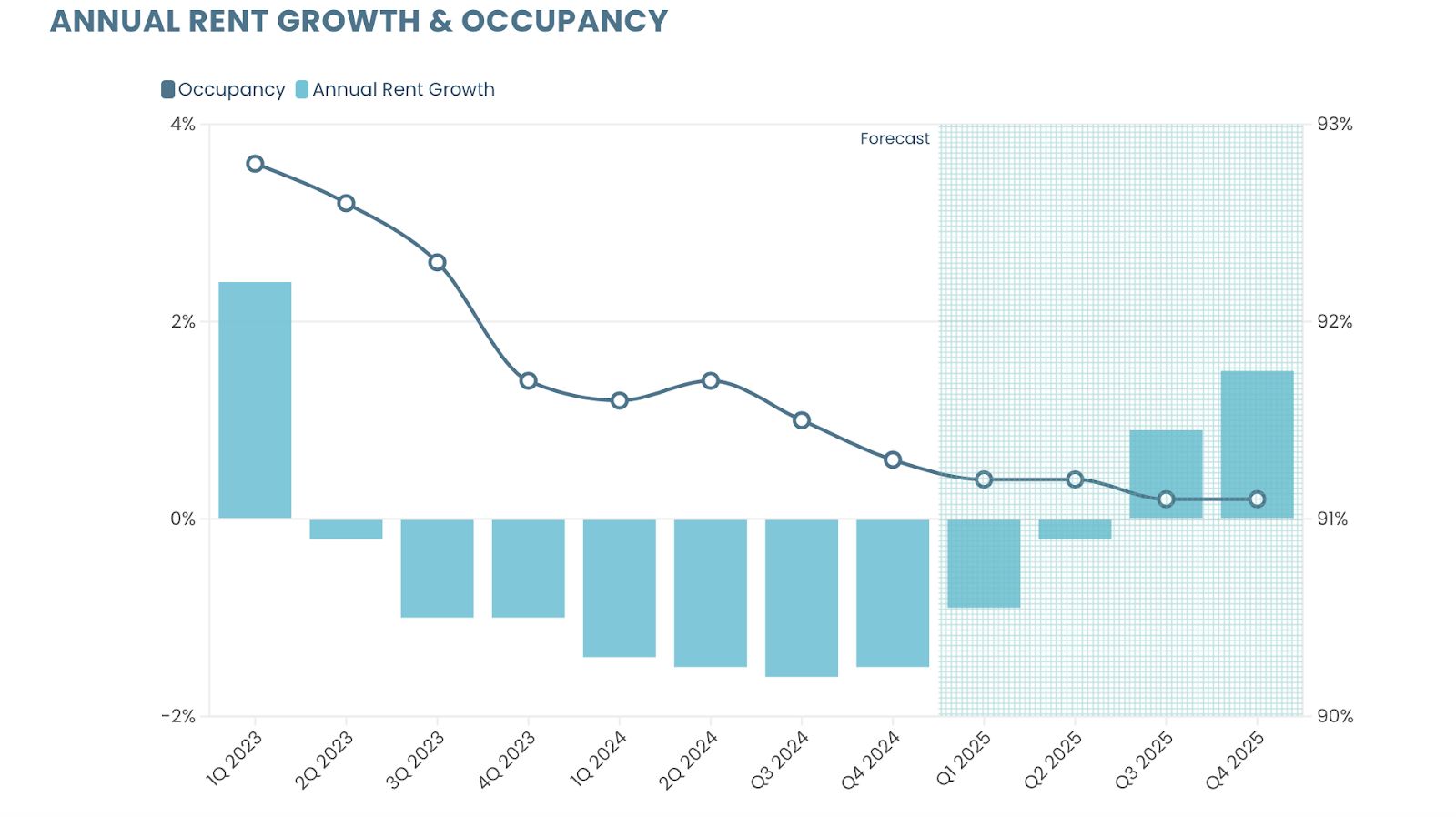

This is where our 5th-grade economics comes into play—supply vs demand. While demand has remained strong, as we’ll see shortly, it hasn’t been enough to keep up with the thousands of new units hitting the market. As a result, rents have stayed flat or even declined.

Occupancy dipped to 92.7% this quarter, falling well below the national average.

That may sound discouraging, but there’s a silver lining, and we can see it in the data. But let’s not forget the noise we mentioned earlier: equity markets, bond yields, tariffs, trade tensions, DOGE, etc. Amidst all that, the key takeaway is to understand that recessions tend to suppress apartment demand and I’m not sure how all of these factors will play into the likelihood of recession in the coming year.

Here is what I do know: Demand is critical to pushing Dallas and other Sunbelt markets back into positive rent growth. If it doesn’t continue to show up, we may be stuck in this low-to-flat rent growth cycle for longer than expected.

That said, here’s what I’m seeing right now:

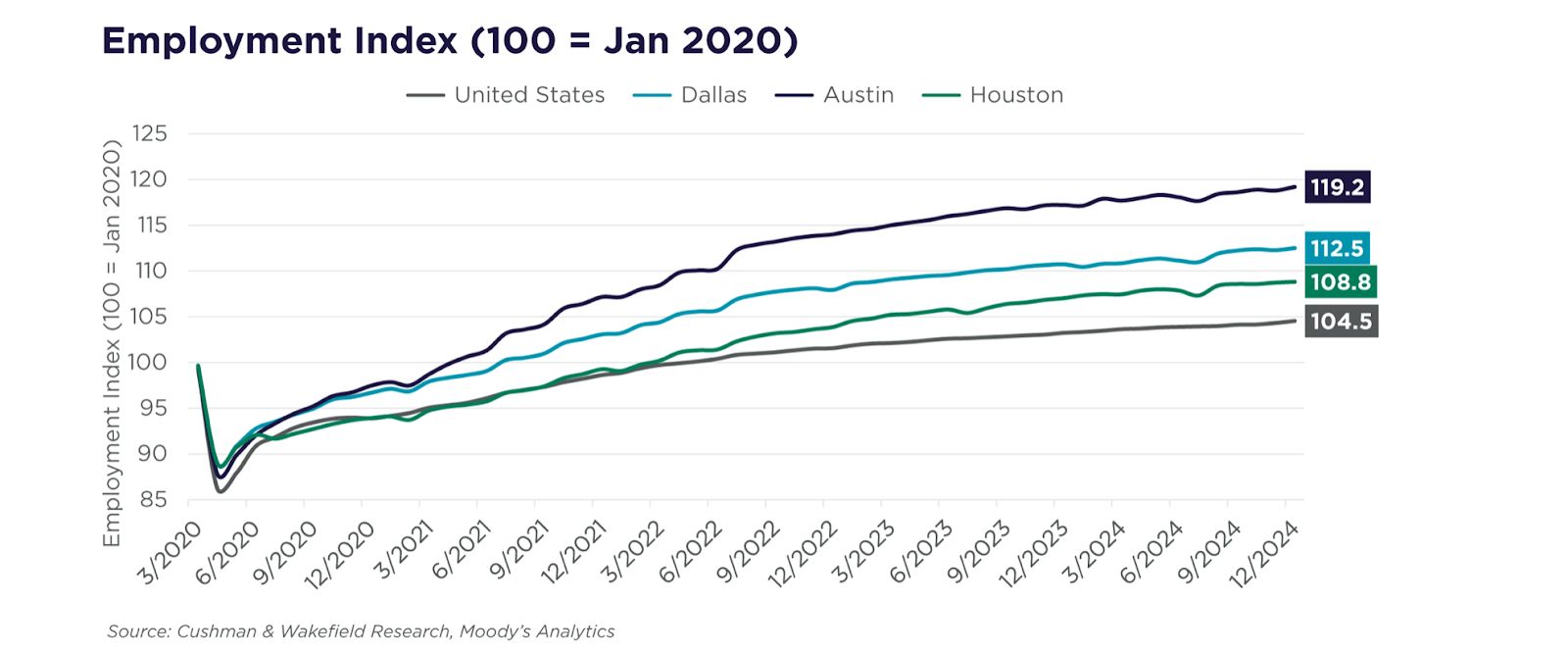

Employment Remains Strong:

Year-over-year employment growth in DFW stands at 1.6%, outpacing the national rate of 1.3%. The unemployment rate closed out 2024 at just 3.5%, notably lower than the U.S. average. (Source: Yardi)

Demand Hasn’t Gone Anywhere:

DFW led the nation in absorption for Q1 2025, matching—or even exceeding—the impressive levels we saw in 2024. The takeaway? Demand is still very much alive and kicking.

Rents Are Showing Signs of Life:

There looks to be some momentum going into 2025 as rents are creeping back up into positive growth territory.

When Will the Supply Wave Slow in Dallas?

Looking ahead—and at the data below—it’s clear the wave is starting to lose steam.

Source: MMG

Source: MMG

As illustrated in the chart above, there's anticipated mild rent growth this year as completions dwindle. However, a substantial amount of supply remains to be absorbed.

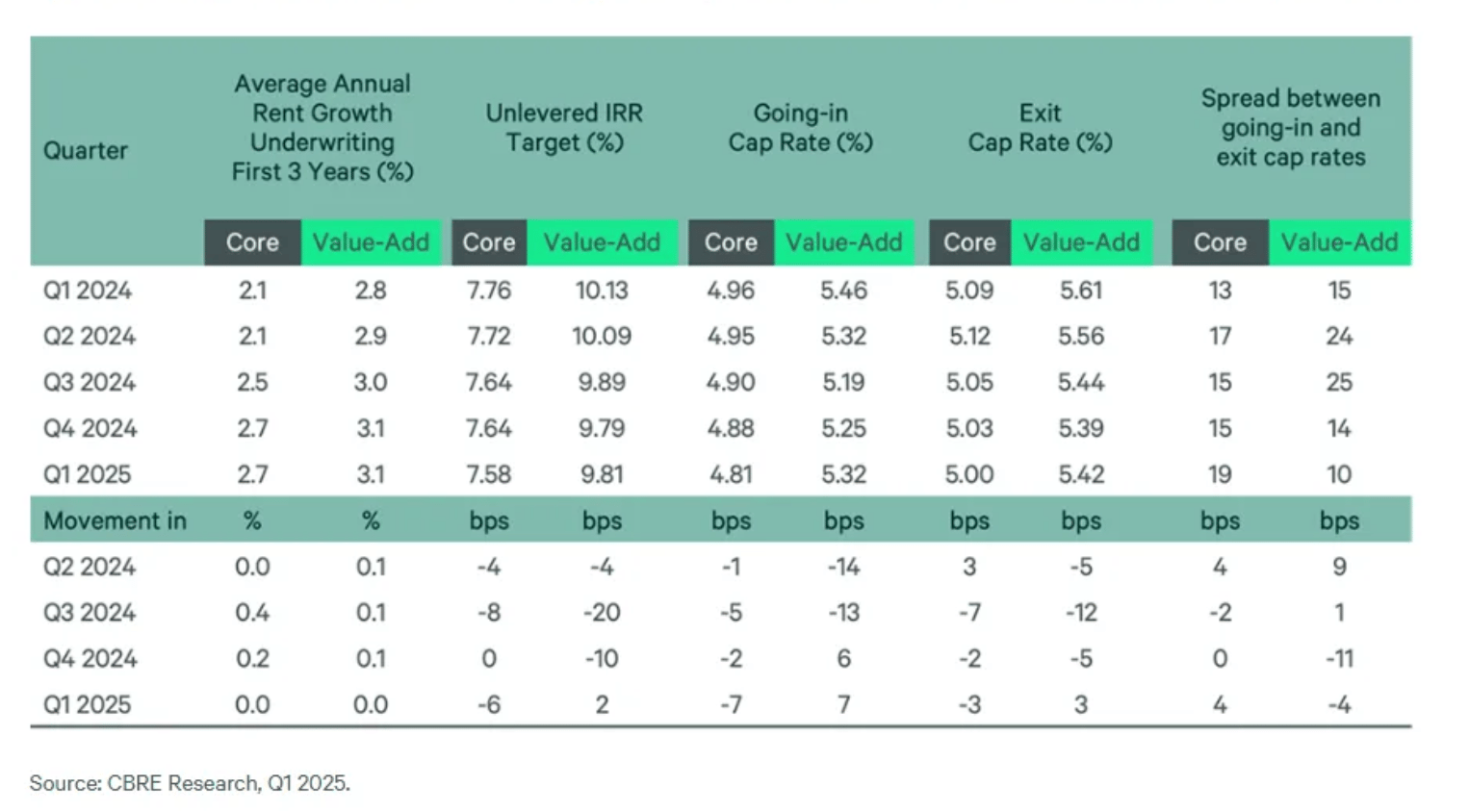

While not specific to Dallas, the below insights can provide guidance for Dallas investors. If you're encountering a 4.0% exit cap rate, it's crucial to ask a lot of questions and stress-test to see what it looks like with a ~6.5% exit cap rate. The movement in returns will be huge, and might lead to loss of principal investment.

A Silver Lining Amidst the Noise: A Coming Supply Gap

That same noise that could push us into a recession, is also a bit of a silver lining. There are very few developers who have started projects in 2023, 2024, and 2025 due to high interest rates, falling rents, and economic turmoil.

This should eventually lead to undersupply in 2026, 2027, and 2028 which would result in strong rent growth.

Guidance for Limited Partners in Dallas

For limited partners evaluating investment opportunities in Dallas, inquire about the operators' rent growth assumptions. Stress-test and see what happens if the rent increases are not achieved. Your capital depends on it!

Thanks for reading! If you’re interested in North Carolina single-family development or existing multifamily opportunities, you can follow along by clicking here. I usually only come across 1–3 deals per year that are worth investing in.

Have a great week!