- Real Estate Observer

- Posts

- Weekly Observations + More Private Credit

Weekly Observations + More Private Credit

What questions to ask prospective private credit funds, Charlotte reaching peak supply, Effect of recession on rent growth

This newsletter provides frameworks & information you can use to confidently invest your capital in private market real estate.

REAL ESTATE OBSERVER RECENT ARTICLES 📰

Rent Growth Assumptions- Organic Rent Growth, Why Do Rents Fall, Resources to Check Rent Growth

Real Estate Private Credit- And what questions should you ask on your search for cash flow/current yield?

Real estate private credit is experiencing significant investor interest among LPs & those seeking real estate exposure without the full risk profile of common equity investments.

I still believe there to be opportunity in common equity and I’ll continue to place dollars there, but there is certainly an appeal for RE private credit. It typically produces 8-14% annually while keeping a more conservative position through debt or preferred structures. That’s the idea anyways.

Finish reading here.

NEWS ARTICLES 📢

Data & Graphs to Consider

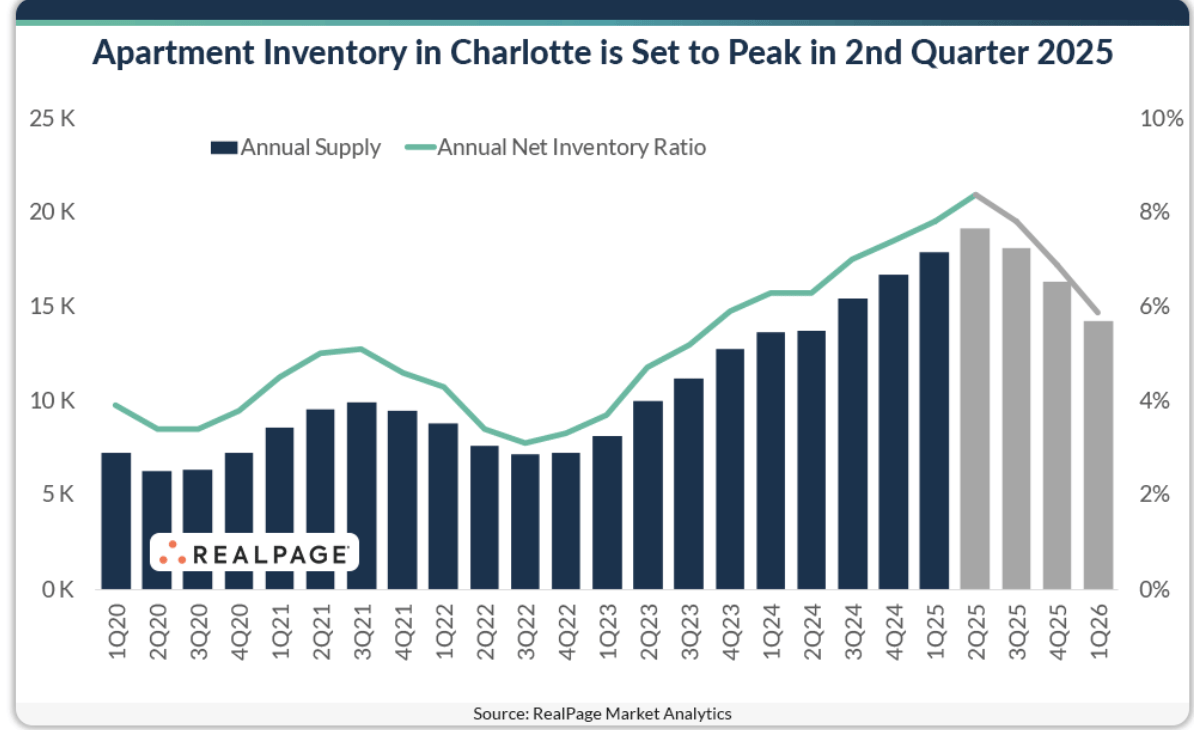

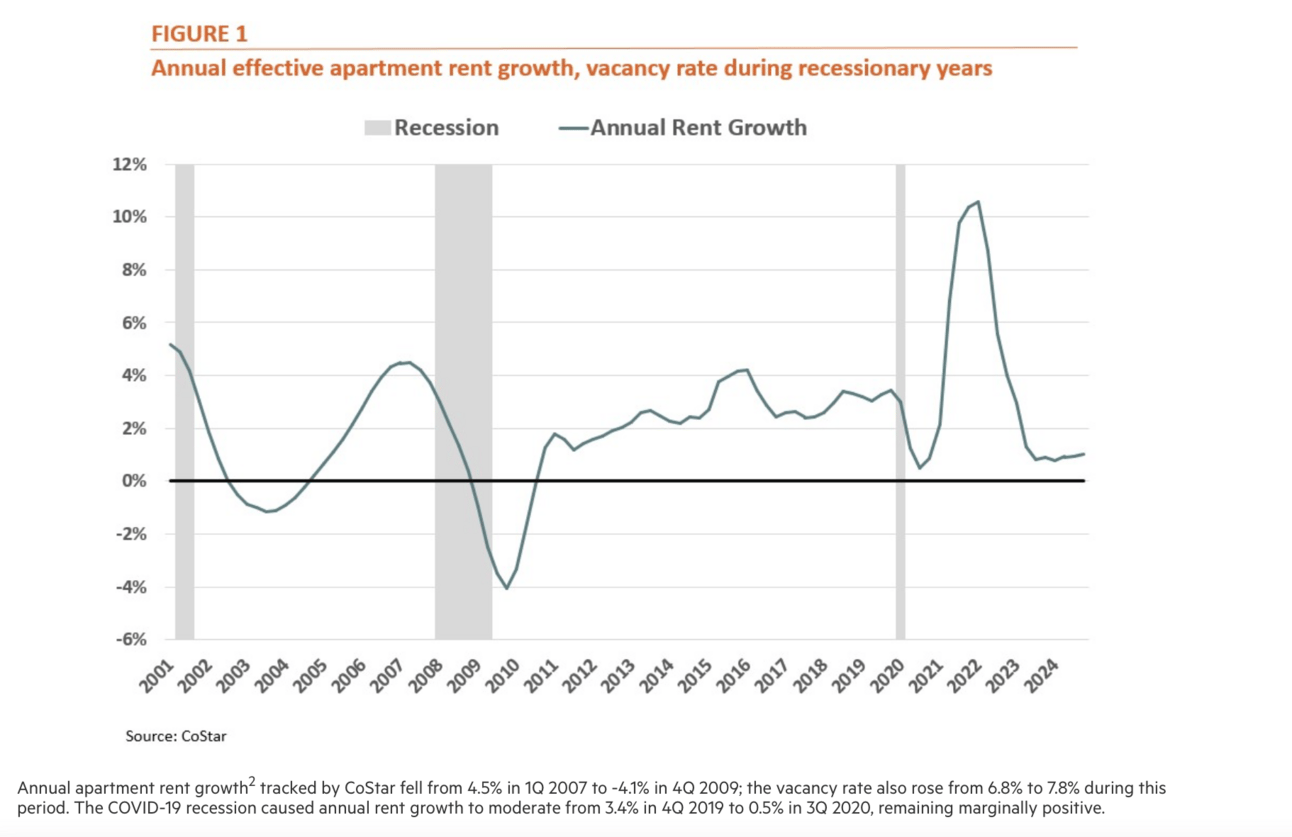

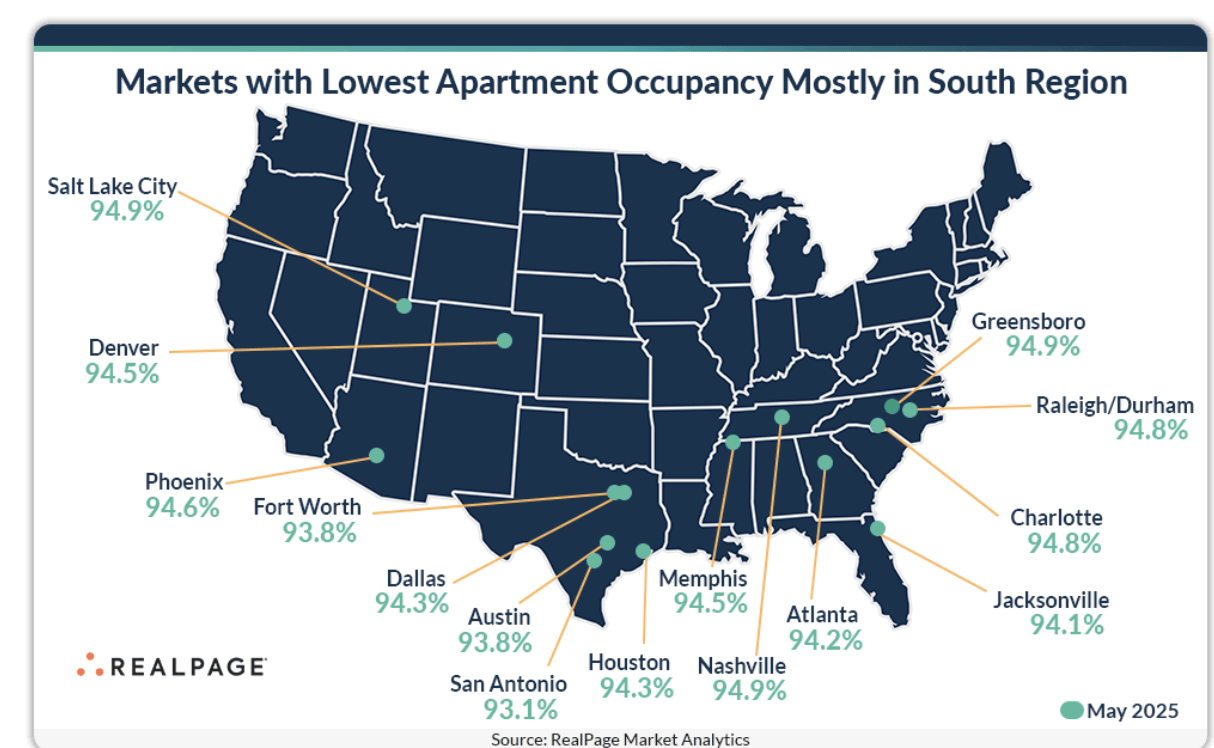

This narrative of peaking supply, and rent growth on the horizon in Sunbelt markets will continue to be heard. It looks promising, but are we relying or assuming too much that the demand story will continue to be rosy?

Deal Review

As a thank you for being a Real Estate Observer subscriber, if you’re considering a private real estate investment and would like a free deal review, email me your pitch deck and any associated docs at [email protected]. Competent in multifamily, SFR, & BTR.

Thanks for reading! As always, please feel free to reach out with any questions or feedback.